Issuers

Maldives Islamic Bank

Board Members

Kazi Abu Muhammad Majidur Rahman

Chairman and Non-Executive Independent Director

Nasser Mohammed Al-Thekair

Non-Executive Director

Rajiv Nandlal Dvivedi

Non-Executive Independent Director

Moez Baccar

Non-Executive Director

Osman Kassim

Non-Executive Director

Mausooma Yoosuf

Non-Executive Director

Ahmed Siraj

Non-Executive Director

Aminath Irthiyasha

Non-Executive Director

Iyaz Waheed

Non-Executive Independent Director

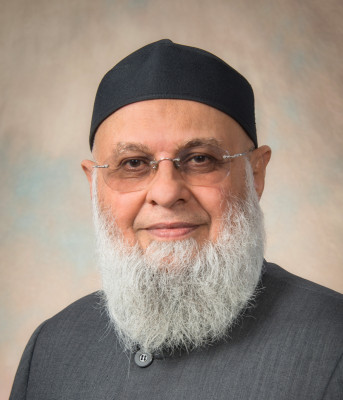

Mufaddal Idris Khumri

Managing Director & Chief Executive Officer

Ali Wasif

Executive Director / Chief Financial Officer

Board Committees

Board Audit Committe (BAC)

4 Members

The Board Audit Committee (BAC) has been formulated as per clause 1.8, Part 2 of the Corporate Governance Code. The primary role of the BAC is to assist the Board in fulfilling its oversight responsibilities in areas concerning the integrity of financial reporting, the effectiveness of internal audit function and internal control systems, frameworks as well as consideration of ethics and compliance matters.

Members of the committee

Iyaz Waheed

Moez Baccar

Mausooma Yoosuf

Aminath Irthiyasha

Board Risk and Compliance Committee (BRCC)

4 Members

The Board Risk and Compliance Committee (“BRCC”) is responsible for ensuring the continuous oversight of the risks embedded in the Bank’s operations. The Committee advises the Board in relation to current and potential future risk exposures of the Bank and future risk strategy including the determination of risk appetite and tolerance. The BRCC also ensures the effective management of compliance, operational, market, reputational and liquidity risk throughout the Bank in support of the strategy and framework approved by the Board.

Members of the committee

Nasser Mohammed Al-Thekair

Rajiv Nandlal Dvivedi

Ahmed Siraj

Aminath Irthiyasha

Board Nomination and Remuneration Committee (BNRC)

4 Members

The Board Nomination and Remuneration Committee (“BNRC”) was established in accordance with Section 1.8, Part 2 of the Corporate Governance Code and as per Articles of Association of the Bank. The committee is governed by the Terms of Reference (“ToR”) approved by the Board. The Nomination Committee and Remuneration Committee is combined as one to facilitate effective and efficient discharge of the duties in consideration to the mandate and functions of the two committees.

The Committee was established by the Board of Directors on 11th March 2019. The Committee started its function after conversion of the Bank to a Public Limited Company and had its first meeting on 24th July 2019. The committee was reconstituted by the Board of Directors twice during the financial year 2022.

Members of the committee

Osman Kassim

Nasser Mohammed Al-Thekair

Ahmed Siraj

Mausooma Yoosuf

Board Investment Committee (BIC)

4 Members

The Board Investment Committee (“BIC”) is responsible for review and approve the Bank’s financing exposures and investment portfolios.

The Committee was established by the Board of Directors on 20th December 2022.

Members of the committee

Rajiv Nandlal Dvivedi

Osman Kassim

Moez Baccar